sacramento county tax rate 2021

This is the total of state and county sales tax rates. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and.

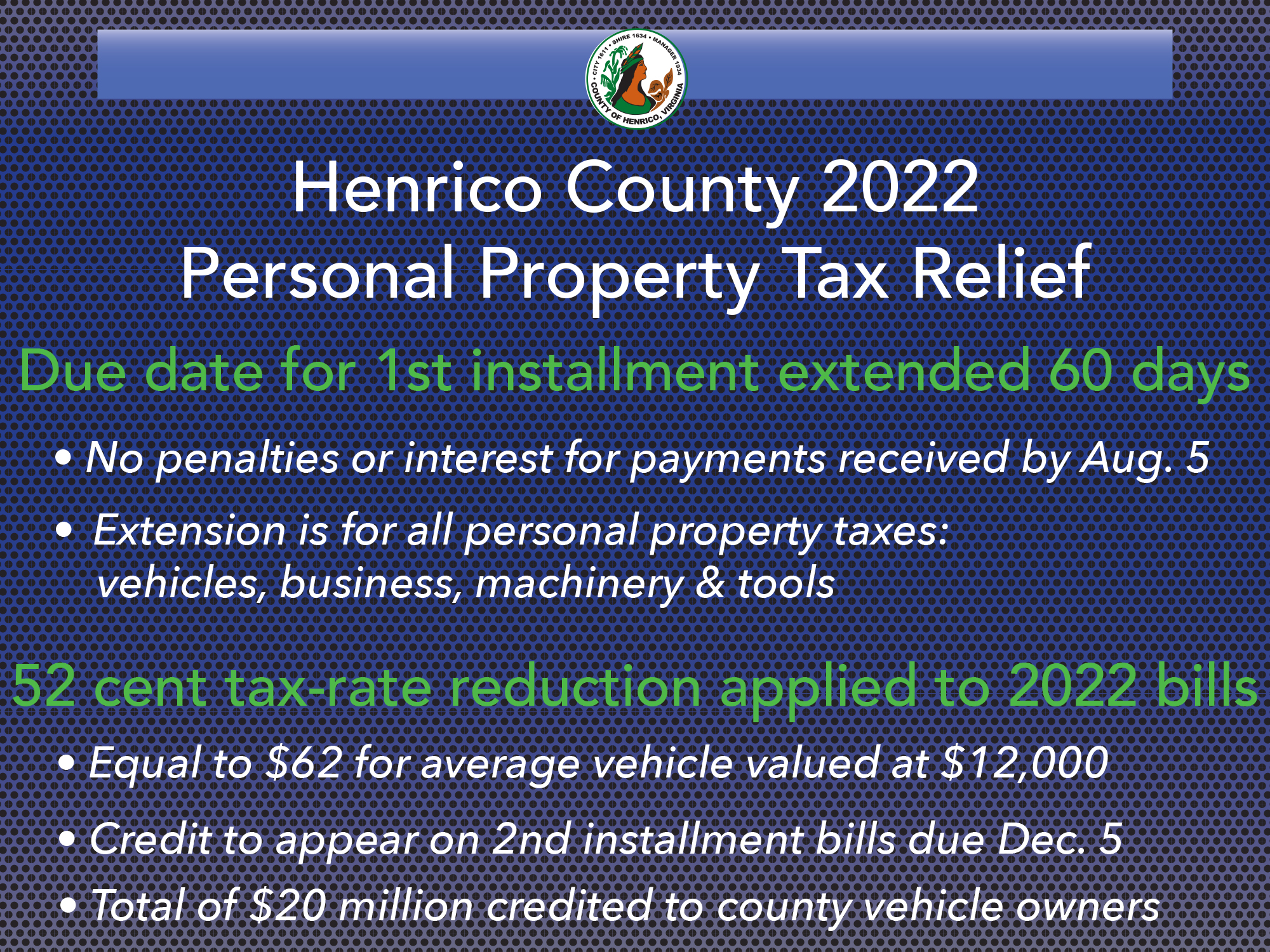

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Historical Tax Rates in California Cities Counties.

. Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from 900am to 400pm or via email at TaxSecuredsaccountygov. The latest sales tax rate for Sacramento CA. The minimum combined 2022 sales tax rate for Sacramento California is.

What is the sales tax rate in Sacramento California. The current total local sales tax rate in Sacramento County CA is 7750. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1.

The statewide tax rate is 725. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The total sales tax rate in any given location can be broken down into state county city and special district rates.

We strive to provide the general public and taxpayers with the highest possible level of customer service and care. As we all know there are different sales tax rates from state to city to your area and everything combined is the. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The property tax rate in the county is 078.

If we may be of any help or if you have any suggestions on how we. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021. Sacramento County collects on average 068 of a propertys.

2020 rates included for use while preparing your income tax. California has a 6 sales tax and Sacramento County collects an. What is the sales tax rate in Sacramento County.

Those district tax rates range from 010 to. The minimum combined 2021 sales tax rate for Sacramento California is 875. Method to calculate Sacramento County sales tax in 2021.

This is the total of state county and city sales tax rates. 075 lower than the maximum sales tax in CA. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

This rate includes any state county city and local sales taxes. The December 2020 total local sales tax rate was also 7750. View the E-Prop-Tax page for more information.

This is the total of state county and city sales tax rates. Equalized Rolls - District Valuation Report. The minimum combined 2022 sales tax rate for Sacramento County California is.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. The California sales tax rate is currently 6.

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

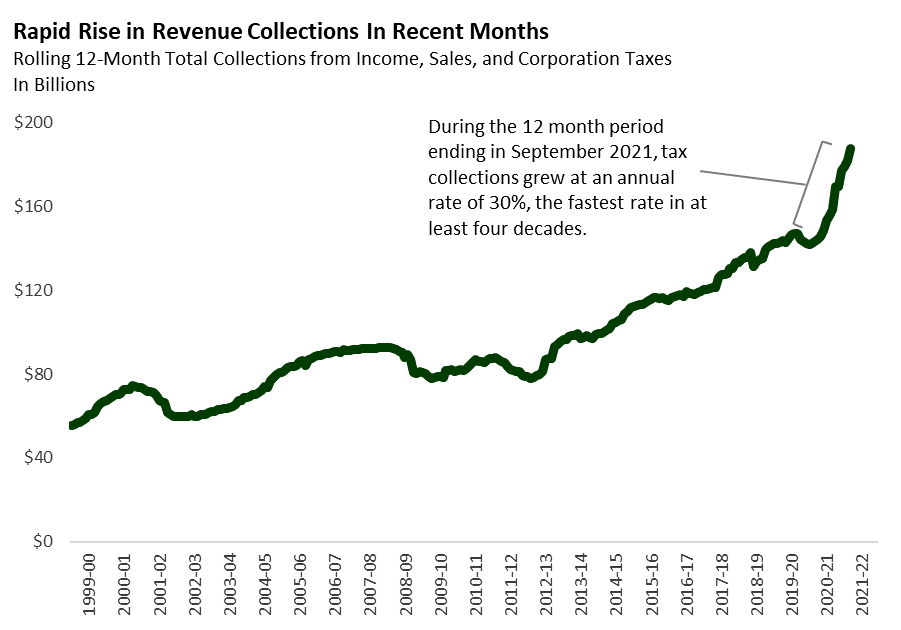

2022 23 Fiscal Outlook Revenue Estimates Econtax Blog

Pin On Real Estate And Local Vegas Info

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Alameda County Ca Property Tax Calculator Smartasset

Missouri Income Tax Rate And Brackets H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Cryptocurrency Taxes What To Know For 2021 Money